Gimi - Pocket money app

Description of Gimi - Pocket money app

Gimi is an educational pocket money app designed for children and their families, aiming to teach financial skills in a straightforward and engaging manner. This app allows users to manage allowances and track chores digitally, making it easier for both children and parents to stay organized. Gimi is available for the Android platform, allowing users to download the app to enhance their financial literacy experiences.

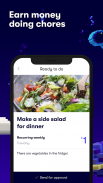

Children can utilize Gimi to keep track of their money, allowing them to understand the concept of earnings and spending. The app encourages them to complete chores, which helps instill a sense of responsibility and enables them to take charge of their finances. By setting up savings goals, children can learn to save for items they desire, teaching them the value of delayed gratification.

In Gimi, children also have the opportunity to rate their purchases. This feature helps them evaluate their spending habits and learn to prioritize where their money should go. The app includes a unique reward system where users can earn XP (experience points) by engaging with various financial challenges, stories, and quizzes. This gamified approach aims to make learning the basics of personal finance enjoyable and accessible.

Parents benefit from Gimi as well. They can schedule allowances to ensure that payments are made consistently, eliminating the need for manual tracking. The app allows parents to assign chores, streamlining household responsibilities and reducing the need for reminders. Additionally, they can establish a bonus rate to reward their child's saving efforts, further encouraging responsible financial behavior.

Gimi also includes features that allow parents to monitor their child's learning journey. Parents can track their child's progress in mastering personal finance topics through interactive lessons. This oversight ensures that families can engage with financial education together and incorporate money management discussions into everyday life.

To further reinforce financial concepts, Gimi includes money missions that encourage families to participate in activities related to personal finance. These missions promote bonding and practical application of financial skills, making the learning experience holistic and collaborative.

The app provides children with a clear understanding of what they can afford, not only in traditional currencies but also in gaming currencies and cryptocurrencies. This aspect broadens their comprehension of money in various contexts, which is increasingly relevant in today's digital economy. By engaging with these different forms of currency, children can develop a well-rounded perspective on money management.

With Gimi, children can learn about budgeting and managing their finances through interactive tools and features. The digital piggybank replaces traditional methods, offering an easy way to visualize savings and expenditures. This modern approach to financial literacy aims to provide children with skills that will benefit them throughout their lives.

Gimi emphasizes the importance of setting financial goals and working towards them. Children can create specific savings targets and track their progress, making the process more tangible and motivating. This goal-oriented approach encourages children to think critically about their financial decisions and understand the implications of their spending habits.

Moreover, the app fosters a sense of accountability. By managing their money and completing assigned chores, children learn the importance of responsibility in financial matters. This skill set is essential as they transition into adulthood and face more complex financial situations.

Gimi is designed to be user-friendly, ensuring that children can navigate the app with ease. The layout is intuitive, allowing for a smooth user experience while they engage with the financial lessons and tools available. The app caters to different learning styles, incorporating visual and interactive elements to enhance understanding.

The dual nature of Gimi, where both children and parents are involved, creates an environment conducive to learning and discussion. Parents can share insights and experiences, fostering open communication about money management within the family. This collaborative approach helps demystify financial topics and encourages lifelong learning.

By utilizing Gimi, families can take an active role in financial education. The app provides a structured yet flexible framework for teaching financial principles, allowing families to adapt the lessons to their unique needs and circumstances. Children can grow their financial skills in a supportive environment, equipping them for future challenges.

Incorporating Gimi into daily routines can lead to a more financially aware generation. The app not only teaches children about money but also encourages positive habits that can last a lifetime. By promoting savings, responsible spending, and goal setting, Gimi cultivates a foundation for financial literacy that is essential in today's world.

For more information about Gimi, you can visit their official website: https://www.gimitheapp.com/terms/